Riding the Rhythm: How Intraday Volatility Shapes Market Movements

A Quick, Data-Driven Dive into the Market’s Daily Ebb and Flow—and What It Means for Your Trades

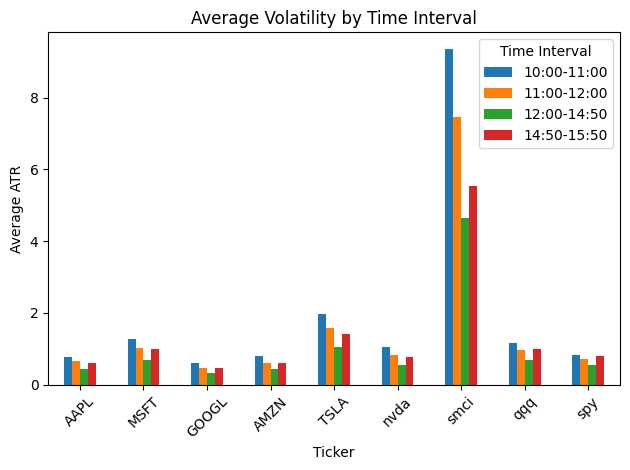

Below you’ll find the results of an intra-day volatility analysis I ran a while ago. In it, we can see that volatility peaks from 10-11, starts to gradually decline from 11-12, then from noon till 2:50pm it drops, while the last hour normally sees a return to vol levels from around 1-1:30

Volatility refers to the degree of variation in the price of a financial instrument over time. In simpler terms, it’s a measure of how much and how quickly the price of an asset, such as a stock or bond, moves up or down. High volatility indicates significant price swings, while low volatility suggests more stable prices. Understanding volatility is crucial for investors, as it helps assess the risk associated with an investment. For instance, a highly volatile stock may offer the potential for higher returns but also comes with increased risk of loss. Conversely, a stock with low volatility might provide more predictable returns but with limited growth potential.

Intraday volatility can reveal a lot about the rhythm of the markets. It’s a key factor for traders and investors, especially those in options, who need to work with price movement in real-time. After observing the way volatility clusters around certain intervals during the trading day, I ran a data-driven analysis to confirm what intuition had already suggested. The results were clear: specific times of day do consistently see changes in volatility, providing a tactical advantage for those who can align their trades accordingly. Here’s find a table based on these observations to help frame what it means for trading—especially options.

Keep reading with a 7-day free trial

Subscribe to The Underlying to keep reading this post and get 7 days of free access to the full post archives.